Luckily Yahoo Finance provides a estimate of implied volatility also so we have something to benchmark on. Let's try calculating the implied volatility for Tesla options. This function is quite fast which is good and it seems to work correctly. The small example below tests that the implied volatility function calculates things as expected. Raise ValueError("type_ must be 'put' or 'call'") Res = minimize_scalar(put_obj, bounds=(0.01,6), Res = minimize_scalar(call_obj, bounds=(0.01,6), method='bounded')

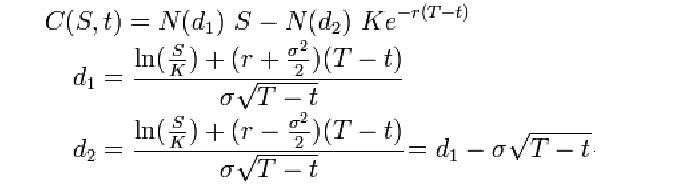

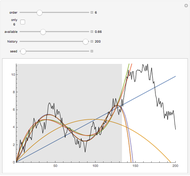

Return abs(BS_PUT(S, K, T, r, sigma) - opt_value) Return abs(BS_CALL(S, K, T, r, sigma) - opt_value) The Black-Scholes functions BS_CALL and BS_PUT are explained here.įrom scipy.optimize import minimize_scalarĭ1 = (np.log(S/K) + (r + sigma**2/2)*T) / (sigma*np.sqrt(T)) This is perhaps due to that fact that vega will be close to zero for out of the money options. This method seems to be more robust than the Newton implementation shown previously. To complete the logic above we will use Scipy's minimize_scalar function which uses Brent's method underneath the hood. Let \(V\) below be the value of a European call or put option. This number was chosen without much thought, so feel free to change it or let me know if it should be higher/lower. We have bounded this minimization such that the volatility is less than 600%. Below we minimize the absolute difference between the market price and the Black-Scholes price. We can look at calculating implied volatility as a minimize problem. The plot below is the implied volatility curve for Apple options as discussed in the article on binaries. In the article on binary options we observed from market data that the volatility is not constant from market prices and this implies a heavier tail probability that the log-normal distribution that the Black-Scholes model assumes. To see a from scratch implementation of calculating implied volatility using Newton's method see here. In this article we will calculate the implied volatility for options at different strikes using Scipy. Since volatility is the only parameter which is unobserved (in Black-Scholes) it is an important concept to grasp. The volatility smile is related to the fact that options at different strikes have different levels of implied volatility.

0 kommentar(er)

0 kommentar(er)